Christie's Re-Enters The Classic Car Auction Market Through Acquisition of Gooding & Company

Patrick Jackson •27 September, 2024

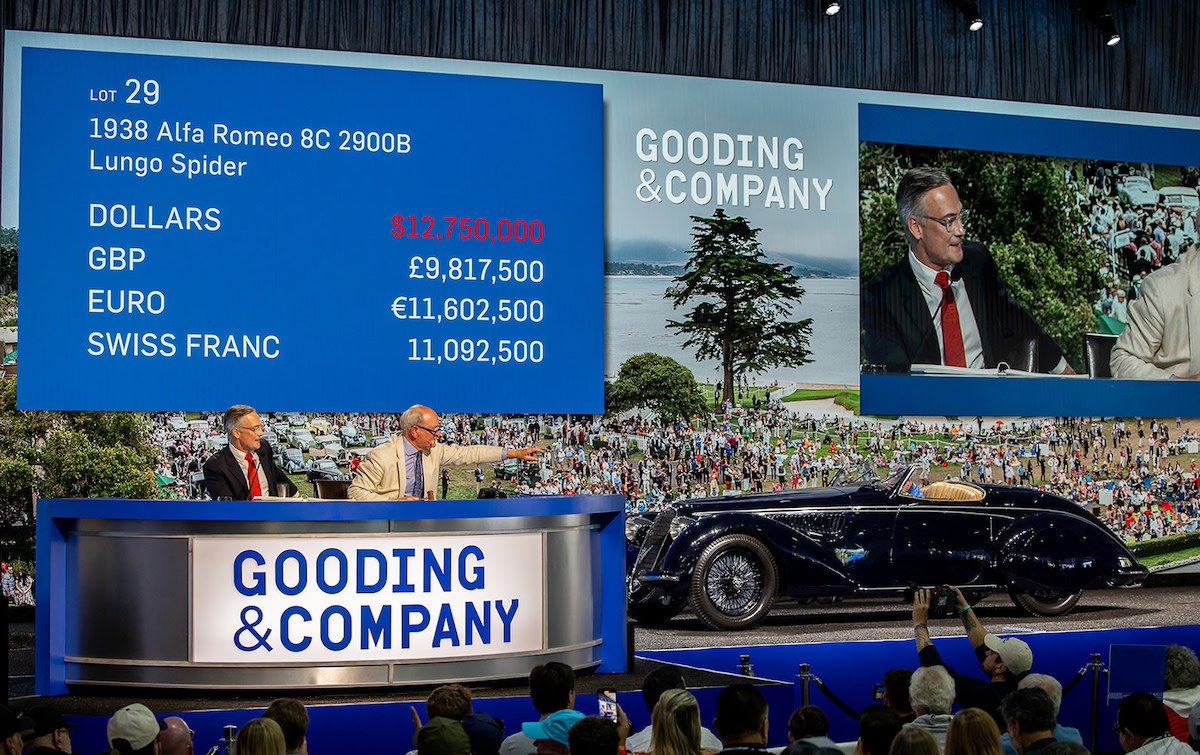

This 1938 Alfa Romeo 8C 2900B Lungo Spider fetched a staggering US$14 million when auctioned by Gooding & Company at Pebble Beach in August 2024 (Image: Gooding & Company)

British-based auction house Christie's, best known for selling fine art, has entered the classic car market by acquiring Gooding & Company.

Announced earlier this month, the undisclosed sum paid by Christie's for the Los Angeles-based consignor is said to be its largest in over 20 years.

Although it has occasionally sold cars as part of collections, Christie's exited the car auction market in 2007. However, amid a declining art market, this acquisition is one which makes great sense.

After setting a record year for any auction house with US$8.4 billion (A$12.2 billion) in sales of art and luxury goods during 2022, Christie's is only on track for around half that this year.

Gooding & Company has handled a number of high-profile auctions, including this 1937 Bugatti Type 57SC Atalante which won First in Class at the 2023 Pebble Beach Concours d’Elegance (Image: Gooding & Company)

Based off H1 figures for 2023 and 2024, its auction sales have declined 22 percent year-over-year.

Gooding & Company president Dave Gooding previously worked for Christie's during the '90s, making the pairing a natural one. He will retain his position with the company he founded in 2003, and it will retain its LA headquarters.

In what has been described by many as an oversaturated market, this is seen as a positive even by competitors. Speaking with Bloomberg, RM Sotheby's CEO Rob Myers said this is a positive for the industry and "fosters healthy competition".

This comes after RM Sotheby's and Hagerty went head-to-head with auctions in Florida earlier in 2024 which divided potential buyers and sellers.

Gooding & Company was one of a number of auction houses that handled big-money sales at Monterey Car Week this year, although there are signs that the car auction market has slowed slightly here in Australia.

Patrick Jackson

Get The Latest

Sign up for the latest in retro rides, from stories of restoration to community happenings.